Many traders ask themselves, “Is automated trading for everyone?” More specifically, “Is automated trading right for me?”.

The answer is simple.

If any trading is right for you then you can benefit from automating some or all of your trading actions.

Some traders operate under the misconception that they need to have a robust and comprehensive trading system, that will work under changing market conditions, in order to benefit from automated trading. Other traders might believe that they need to find the right pre-programmed “bot” or they need to learn how to code.

This may have been true up until recently. With Capitalise.ai’s game-changing automation capabilities, automating your next trade’s execution is a matter of minutes, which saves hours of staring at the screens and waiting for the right moment to act. Simple or more complex trading conditions can be set up to implement one-off trades as well as a series of reoccurring trades.

[br]The well-known benefits of automated trading

- Saving time & breaking free from the screen

No one person can monitor all of their assets during all the hours when all of the markets are open. We all need to sleep, eat and have a life outside of trading. Monitoring the markets 24/7 is definitely a job well suited for a bot rather than a human being.

[br] - Avoiding emotional decision making

The excitement of a fast-moving market often interferes with making the best trading decisions. Fear, greed, and other psychological effects get into action when traders’ money is on the line. Having a clear plan that executes with predetermined entry and exit conditions automatically subtracts emotion from any market execution.

[br] - More efficient and precise trading executions

For manual traders, actualized entry and exit prices often reflect how attentive, agile or accurate a trader was when opening or closing their trades.

How can automation be used to support your manual trading activity?

[br]Monitoring assets and indicators 24/7

Many traders often find themselves spending hours staring at the charts, waiting for the right moment to act. But even a full-time day trader can not be awake for all the activity in all of the markets around the globe. The ongoing monitoring can be exhausting and divert your focus from the important tasks of planning, researching, and analyzing the markets. With Capitalise.ai you can break free from the screen!

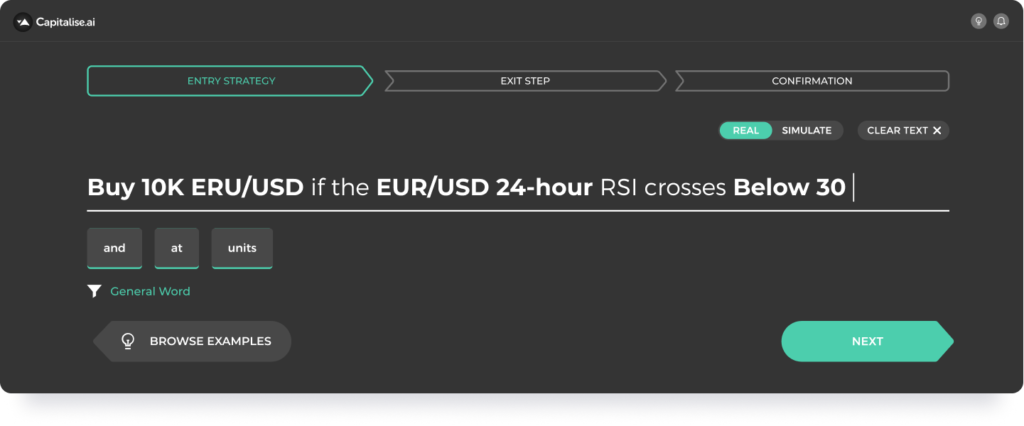

[br] As an example, let’s think of a trader who waits for the RSI of a certain asset to cross below a certain level in order to enter a long trade. Automating such trade is as easy as writing “Buy 10K EUR/USD if the EUR/USD 24-hour RSI crosses below 30”

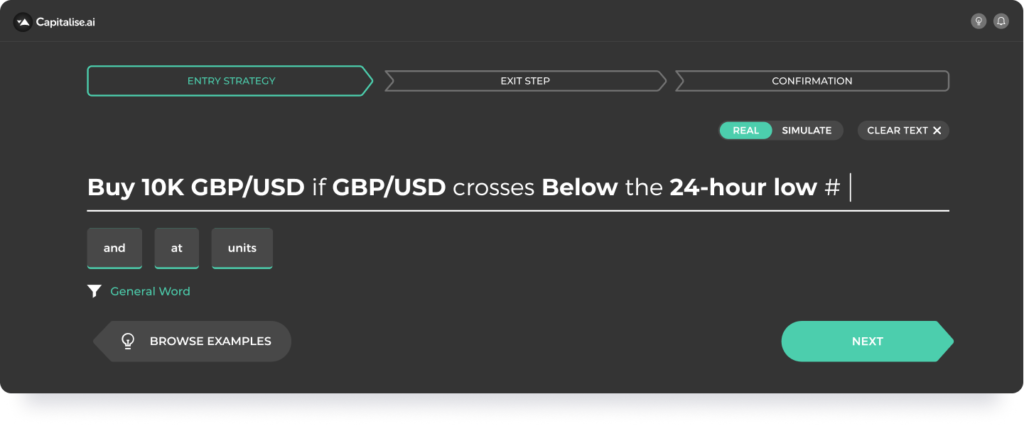

Another example can be entering a trade when the price crosses below the 24-hour low:

In fact, entering your next trade automatically can be applied to any tech indicator, news event, or time frame you’re following. You can even apply TradingView webhooks to use any indicator available on TradingView to trigger your next trade.

[br]

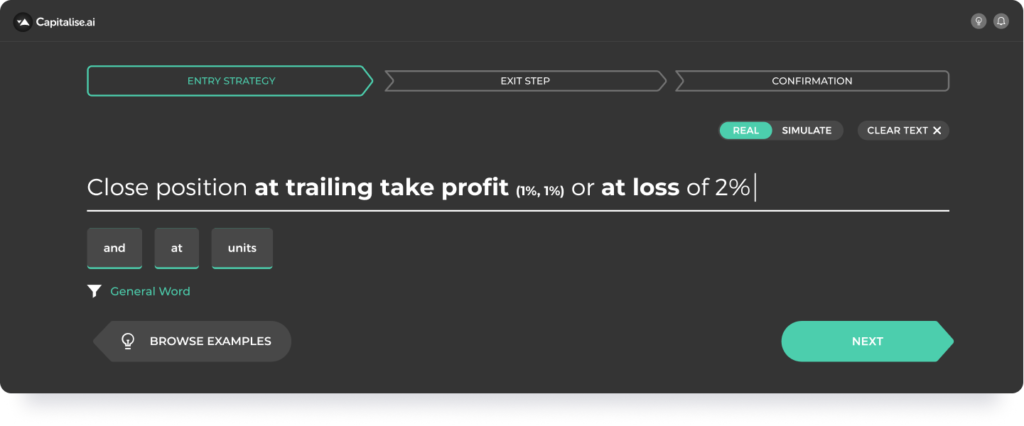

You can also set a trade exit in order to make sure you close your position precisely as planned, for example:

[br]

Setting up a trade for a particular event

A trader can use the economic calendar to see what economic reports are coming out that day or week and set different trades to open whether the report is positive or negative. As an example, if the United States was releasing its monthly unemployment numbers typically on the first Friday, a trader might have one trade or a series of trades set up to trade with or against the value of the dollar. With automated trading, the trader doesn’t have to be awake and monitor for indicators that might get affected by a news event.

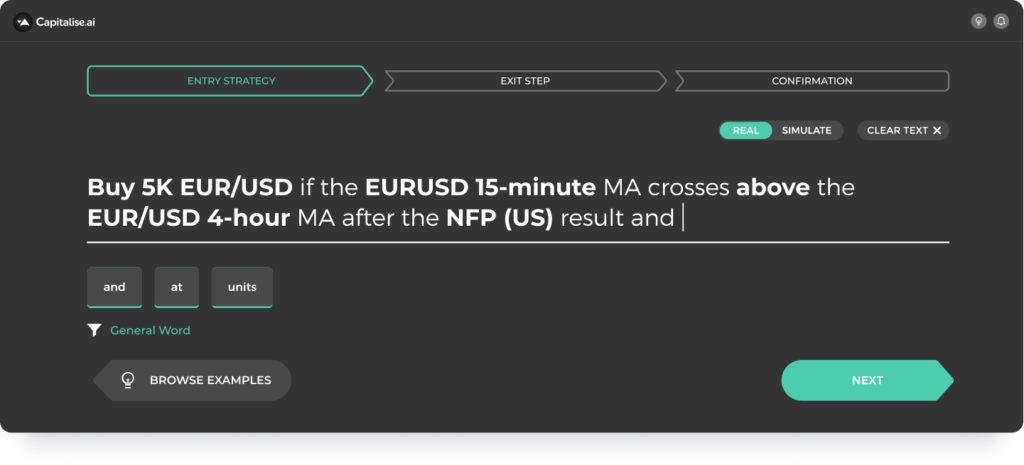

So, let’s look at an example of a simple trade based on the monthly US NFP unemployment numbers.

This trade picks a particular asset that would be affected by US Economic reports. Every asset traded against the USD could be affected. Many traders choose the EURUSD as the value of the Dollar Index is mostly weighed against the EUR. The time condition is set so that only opens if there is a desired amount of change during the time around a major report. There are many ways to set up a trading strategy for an event but whatever conditions a trader chooses will include:

Planning out your daily/weekly trades

Some traders like to designate one day or a certain limitation on how many and which hours they trade daily or weekly. That being the case, even in one hour a trader could set up and activate a trading plan for the day or week. That plan could also include a target for potential profits and a limit on potential losses.

While time can be an obvious obstacle for effective and frequent manual trading, automated trading can easily discount this concern.

Below is an example of a strategy where the trader chose to trade WTI/Crude Oil. The strategy limited at the most 5 trades to open up in a loop with a maximum loss of $500. The strategy also shows a take-profit potential of $1,000 per trade or $5,000 total set previously as an exit condition. So with this strategy activated, if the trader only wanted 5 or fewer trades for the week to open whether it happened in one day or over the course of the full week, the trader could run this strategy live and Capitalise.ai would monitor the markets and execute an order each time conditions are met.

Automate your next trade with Capitalise.ai

Whatever you’re waiting for to happen can be easily set as a condition that will seamlessly open and close your next trade. Don’t wait any further to start saving time, avoid emotional decision-making, and become as fast and precise as a machine. Simply log in to your Capitalise.ai account, type your trading strategy in natural everyday English and let Capitalise.ai monitor the markets 24/7.

Want to gain some confidence first? No worries. Use Simulation mode to test your conditions risk-free before investing your money.